It is required by statute that certain companies and organizations in the UAE undergo a statutory audit. This type of audit is mandated by law to ensure that financial statements accurately reflect the organization’s financial position and performance. The statutory audit serves to provide an independent examination of financial records and practices, ensuring compliance with regulatory requirements set forth by UAE laws and regulations.

It is required by statute that companies operating in both free zone and mainland areas of the UAE undergo a statutory audit.

Which Companies in the UAE should undergo Statutory Audit

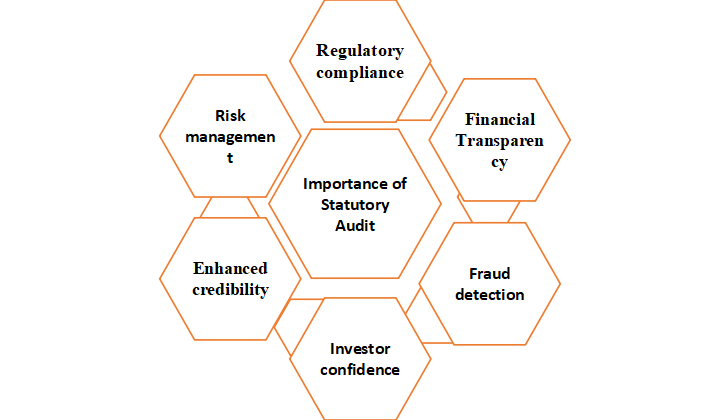

IMPORTANCE OF STATUTORY AUDIT

OUTPUTS OF STATUTORY AUDIT

· Audited Financial Statements: Comprehensive and verified financial statements, including the balance sheet, income statement, and cash flow statement.

· Audit Report: An independent auditor’s report providing an opinion on the accuracy and fairness of the financial statements.

· Management Letter: A letter from the auditor highlighting significant findings, internal control issues, and recommendations for improvement.

· Compliance Certificate: A certificate confirming that the financial statements comply with UAE laws and regulations.

· Audit Trail: Detailed documentation and evidence supporting the audit process and conclusions.

· Financial Analysis: Insights and analysis on financial performance and position, highlighting key metrics and trends.

· Risk Assessment: Evaluation of financial and operational risks identified during the audit.

· Recommendations for Internal Controls: Suggestions for enhancing internal controls and improving financial management practices.

· Tax Compliance Report: Verification of compliance with UAE tax regulations and any related adjustments.

· Governance Assessment: Evaluation of corporate governance practices and their effectiveness.

Tax Audit

A tax audit in the UAE is a statutory review conducted to ensure that a company’s tax filings comply with UAE tax laws and regulations. This audit involves a thorough examination of financial records, transactions, and tax returns to verify accuracy and completeness. The primary objective of a tax audit is to assess whether a business has correctly reported its income, claimed appropriate deductions, and paid the correct amount of tax. Tax audits are mandated by the Federal Tax Authority (FTA) and are crucial for maintaining transparency, ensuring compliance, and avoiding penalties. By conducting regular tax audits, businesses can confirm their adherence to tax regulations and address any discrepancies proactively.

Which Companies in the UAE should undergo Tax audit

In the UAE, businesses are subject to specific tax audit requirements based on their type of registration and activity. Understanding these requirements is crucial for ensuring compliance with federal tax laws.

1. Mainland Companies

Mainland companies in the UAE must adhere to the following tax audit requirements:

· Corporate Tax: As of 2023, mainland companies are subject to corporate tax. If a company is liable for corporate tax, it must prepare financial statements in accordance with International Financial Reporting Standards (IFRS) and may be required to undergo an annual audit by a licensed auditor.

· VAT (Value Added Tax): Companies registered for VAT with the Federal Tax Authority (FTA) must maintain accurate records and may be required to undergo an audit if the FTA deems it necessary. The audit ensures compliance with VAT regulations and accurate reporting.

2. Free Zone Companies

Free zone companies also have specific audit requirements:

· Corporate Tax: Companies operating in free zones may benefit from certain tax incentives, including exemptions from corporate tax. However, they are still required to maintain proper financial records. If corporate tax applies, similar audit requirements as mainland companies will be enforced.

· VAT: Free zone companies registered for VAT must comply with the same VAT audit requirements as mainland companies. They need to keep detailed records and may be subject to audits to ensure compliance.

A finance and Tax Consulting firm established to support, guide and elevate the SME and MSME’s in the UAE.

Social Chat is free, download and try it now here!